Let’s evaluate our fiscal history to understand how we arrived at the present.

Our current understanding of tokenized assets on-chain comes from the pursuit of liquidity. The paired nature of digital assets with other digital assets and the ability to back tokens with the liquidity needed to buy, sell, and trade. The concept of trading has been at the core of our understanding of digital assets.

Token pairing is an improper model for liquidity. Trading volume is not an effective measurement for sustainable liquidity. We need to focus on the tokenization of real-world assets.

The market has always been what the people have made it. The digital asset market is no different. Historically when we have paired currencies together for stability, there has been significant limitations.

Token pairing becomes an unstainable model for long-term, stable liquidity and we need to look at the tokenization of real-world assets as an economic engine for sustainable liquidity without volatility.

“There is an emerging divide between crypto and the tokenization of real-world assets and liabilities,” said Acting Comptroller Michael J. Hsu. “Crypto remains driven by the promise of speculative gains, continues to be marked by rampant scams, fraud, and hacks, and struggles to comply with anti-money laundering rules. By contrast, tokenization is driven by solving real-world settlement problems and can easily be developed in a safe and sound manner and fully compliant with anti-money laundering rules. I look forward to a fulsome discussion on these topics with a range of experts in the field.”

Let’s look at two historical examples on currencies while later we will look at some historical answers to currency pairings:

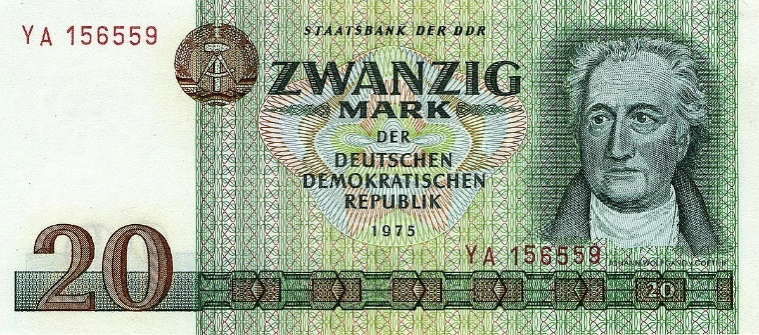

The Fall of Berlin Wall and the 1:1 Peg of the East German Mark and Deutsche Mark

This created a significant step in currency conversation or maybe the way we look at swapping amongst pairs. The conversion of the East German Mark (GDR Mark) to the Deutsche Mark (DM) at a 1:1 ratio for large portion of personal savings, wages, rents, and prices. This conversion was hoped to provide immediate stability and confidence in the East German economy. The challenges become real as the 1:1 peg on these two currencies exposed the productivity and efficiency gap, much like how we could look at token pairings with different utilities. Inflation control with a commitment to price stability was critical in maintaining confidence in the unified currency. Then a number of actors started to weigh-in on the volatility ranging from social transfers, such as the pension system, to an unemployment spike and the costs associated with unification financing through borrowing, impacting Germany’s fiscal policy and debt levels for years.

Picture of an East German Mark (Above)

Picture of a Deutschemark (Above)

The point of the story is the post-Berlin Wall fall demonstrates the complexity of merging two distinct economies and currencies. It highlights the challenges of economic integration and the long-term impacts on economic growth and sustainable liquidity.

The Mexican Peso Crisis of 1994

The Mexican Peso crisis of 1994 was a currency crisis sparked by the Mexican Government’s sudden devaluation of the peso against the U.S. dollar in December 1994, leading to a sever economic downtown in Mexico. The crisis had significant implications for currency trading and foreign exchange markets, highlighting volatility and the risks associated with currency pairs, like how we look at digital asset pairing.

Speculative attacks made the peso a target, as traders bet against the currency’s value, exacerbating its volatility, and making it difficult for businesses to manage risks associated with volatile currency fluctuations. Digital assets are susceptible to speculative attacks especially those with smaller market caps or those that are less established.

Although the digital asset market doesn’t operate with interest rates in the traditional sense, similar instances, such as staking yields, can fluctuate at a significant level. It makes trading tricky, hence why trading with token pair liquidity is not a sustainable methodology.

As the peso crisis unfolded, limited liquidity in the peso dried up, making it harder to execute large trades without affecting the currency’s value. Certain token pairs may suffer from limited liquidity, making it difficult to execute trades without significantly affecting the market price, thereby increasing risk.

The Mexico Peso crisis provides lessons on the complexities of currency pairing highlighting how token pairings can be problematic and unstainable for liquidity.

1992 Mexico Peso (Above)

Monetary Unions, Unconventional Monetary Policies, and Adopting Currency Boards

So is the answer monetary unions, unconventional monetary policies, or adopting currency boards? No. It also helps prove why we need to get rid of token pairing between digital assets.

Well, this still leads to challenges in value and volatility.

Let’s look at 5 examples:

- Bulgaria and its currency board arrangement pegging the Lev to the Euro to stabilize the economy after a hyperinflation crisis. Sure, while it provided stability, it also limited the central bank’s ability to adjust monetary policy in response to economic changes, potentially straining the economy during economic downturns.

- Lithuania used a currency board to peg its Litas to the Euro before fully adopting the Euro in 2015. The fixed rate provided stability but limited money policy flexibility, leading to significant challenges during the 2008 financial crisis.

- Montenegro’s Euro Adoption was unilateral before becoming an official EU member with the lack of control over monetary policy posing risks during economic downtowns.

- Latvia pegged its currency, the Lats, to the Euro before officially joining the Eurozone. This maybe helped stabilize the economy but limited Latvia’s ability to conduct independent monetary policy, particularly during the 2008-2009 financial crisis.

- Zimbabwe’s Multi-Currency System is another example of failed pairings. After experiencing hyperinflation, Zimbabwe adopted a multi-currency system, including the US Dollar and South African Rand, before bringing back the Zimbabwean dollar alongside them. The lack of clear monetary policy led to continued economic stability, inflation, and volatility. Does that sound familiar to the way we rely on trading pairs with Digital Assets ?

Zimbabwe’s Multi-Currency System (Above)

Photo Credit: VOA Africa

Some of these instances were implemented to stabilize currencies and the trade-offs were real, particularly with achieving balance in stability and retaining any flexibility in monetary policy, especially during downturns. We just saw it in 2022-2023 with the collapse of exchanges, digital assets, and the lack of flexibility in monetary policy when needed for stable liquidity.

The Answer for Sustainable Digital Asset Liquidity is Best Outside of Token Pairings

Our current regulations in the United States provide a framework for assets with traditional financial instruments. Also, the regulatory environment is well thought out after history faced its currency challenges. The Great Depression was very real. The 2008 Housing Crisis was very real. We have learned from these errors and now we need to learn from the early stage of digital assets to move toward the tokenization of real-world assets without token trading pairs.

How do we unlock traditional financing for non-liquid assets while providing the necessary liquidity to ensure scale and the stability of markets?

The answer is right in front of us. We have been quick to jump to conclusions on short-term buying and selling while trading with volatile assets unlike traditional finance models. We can find a balance while eliminating the volatile nature of some of these current practices in digital assets with a real-world view of tokenizing assets.

We need to stop pointing fingers at regulators. We need to stop saying the regulators aren’t providing clarity for digital assets. We need to understand the underlying issue of attaching currency trading pairs together is not an economically feasible model. The liquidity is volatile and only benefits those who trade with short-term impact.

As an industry, we need to look at sustainable pathways of liquidity. This means not pairing tokens for trading sake dictating how the flows of market capitalization are interpreted.

We can stop volatility dead in its tracks, and we can back our digital assets with the current regulatory environment. We don’t need to reinvent the financial wheel from traditional financing, yet we can integrate the speed and velocity of digital asset ledgers to ensure transparent and safe transactions. The flow of technology can match our current regulations and our access for liquidity can be different than the dependency on trading.

It is Time for The Archaic Economic Concept of Token Trading Pairs to Become Extinct

The modern concept of trading pairs between digital assets to create liquidity for tokens doesn’t make logical sense. There are several underlying reasons, such as the lack of intrinsic value while pairing such assets to back liquidity relies on perceived value which is volatile and unpredictable.

Just like the example above, specifically Lithuania and Latvia, the dependency on currency pairs is a risky proposition because monetary policy cannot move fast enough sometimes. The interconnected risk of pairing two digital assets ties their fates together. If one asset experiences a downtown, then it can quickly drag down its paired assets.

There can be illiquidity spirals where assets cannot be sold at reasonable prices. Trading pairs can exacerbate this problem if both assets face selloffs. Then bring in arbitrage complexity, while even though arbitrage between trading pairs can support liquidity, the fast-paced nature of these opportunities requires sophistication, limiting participation to a small segment of traders.

The token market lacks standardization of valuation models, security, and regulatory compliance. This lack of standardization can make the concept of using trading pairs to back liquidity challenging and less logical from an economic perspective.

The innovation of tokenizing real-world assets will evolve the market toward sustainable liquidity with token pairing.

The tokenization of real-world assets provides real liquidity stability without volatility.

Token pairings will become extinct as digital assets evolve into what they were meant to be used for and that’s the tokenization of real-world assets.