Building your own robo-advisor from scratch is a time-consuming and technically challenging endeavor, but one that can certainly add value to any fintech startup. And with the ongoing talent shortage and hiring freeze we’ve seen across the tech industry in recent months, finding the right person for the job has never been more difficult.

But fear not, founders, as we’ve not only entered into the era of white-label robo-advisors, fintech startups are now free to pick and choose from a bevy of skilled bots capable of algorithmically doling out the best advice to your clients across the traditional, and increasingly popular alternative investments markets.

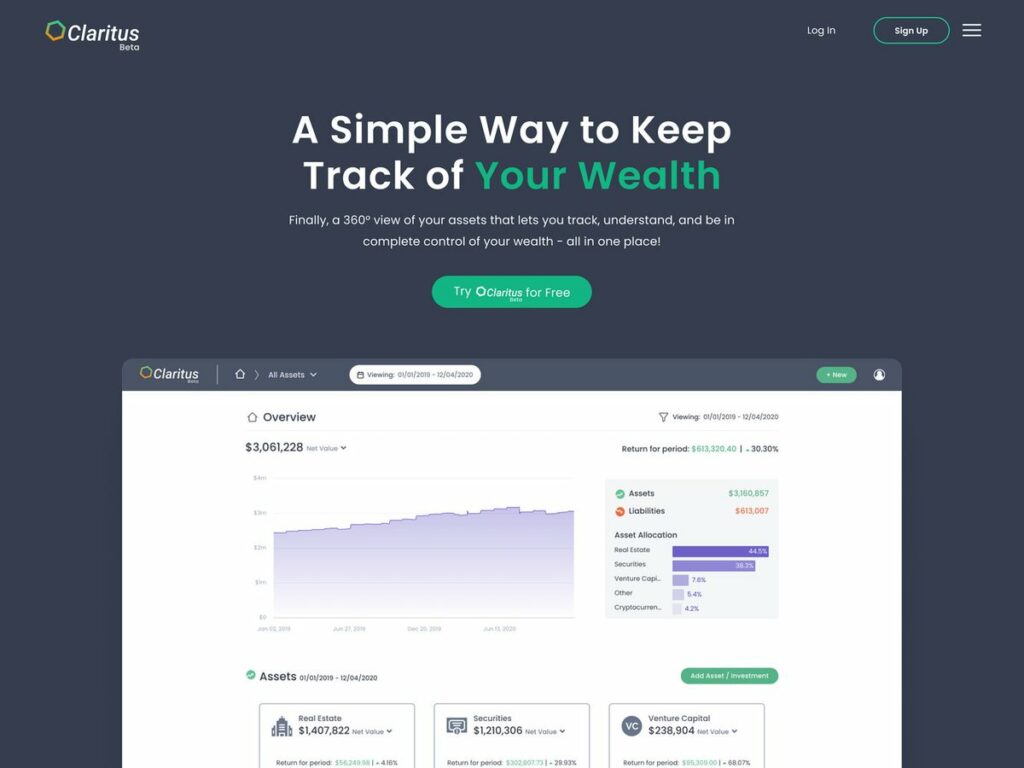

Claritus.io – the personal finance app, is announcing today the launch of its Claritus for Advisors. It’s a new platform that allows advisors to serve their clients with innovative on-the-spot reporting abilities, private wealth intelligence, document storing, and automatic market updates to reflect up-to-date portfolio status aid at providing financial advisory firms of all sizes – including CPAs, RIAs, and family offices – the ability to share and reflect entire portfolios with their clients to dramatically improve collaboration and decision-making processes.

“As more investors pivot to demand a wider spread of alternative and diverse investment opportunities to fill their portfolios amidst the ongoing downturn, Claritus for Advisors is poised to step up to fill that need,” said Shai Azran, Co-Founder and CEO at Claritus.

By utilizing Claritus for Advisor’s whitelabel solution, fintech apps and advisory firms seeking to expand their offering of alternative investment vehicles are presented with a highly collaborative set of resources built to optimize portfolio performance in an easily shareable, highly insightful format. And with over $3 billion in assets supported, Claritus for Advisors not only allows advisory firms the ability to track, maintain, and nurture client portfolios, its powerful insight engine works to provide intelligent decision-making when it comes to optimizing client wealth.

As the demand for alternatives increases, the best way forward for any advisory service or app built to help their clients make and save more money is to broaden their offering and supercharge insight.